7.7 Credit Cards and Other Debt

Questions to consider:

- What do I need to know about student loans?

- How dangerous is debt?

- What should I consider when getting and using a credit card?

Yes, taking on too much debt can (and does) have disastrous effects on people’s personal finances, but if used appropriately, debt can be a tool to help you build wealth. Debt is like fire. You can use it to keep yourself warm, cook food, and ward off animals—but if you don’t know how to control it, it’ll burn your house down.

The Danger of Debt

When you take out a loan, you take on an obligation to pay the money back, with interest, through a monthly payment. You will carry this debt with you when you apply for auto loans or home loans, when you enter into a relationship with a partner in life, and so on. Effectively, you have committed your future income to the loan. While this can be a good idea with student loans, taking on too many loans will make your future self poor, no matter how much money you make. Worse, you’ll be transferring more and more of your money to the bank through interest payments.

Interest

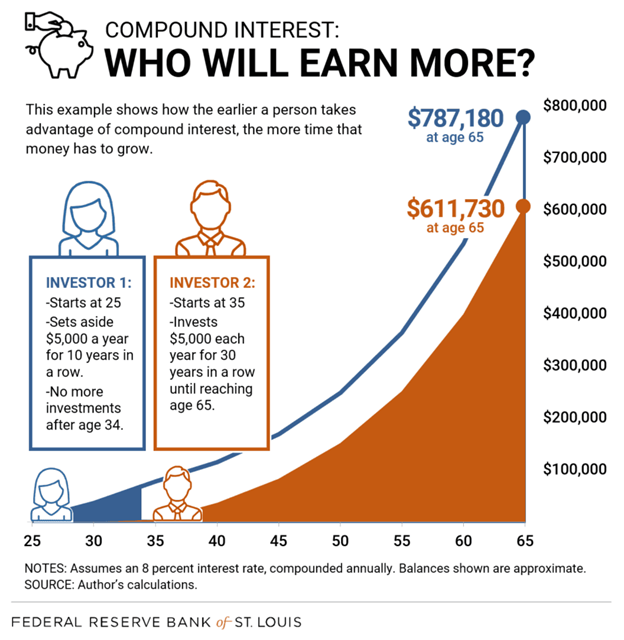

Interest is the fee paid to use someone else’s money. Compound interest is the interest you earn on interest. This can be illustrated using basic math: if you have $100 and it earns 5% interest each year, you’ll have $105 at the end of the first year. At the end of the second year, you’ll have $110.25.

While compounding works to make you money when you are earning interest on savings or investments, it works against you when you are paying interest on loans. To avoid compounding interest on loans, make sure your payments are at least enough to cover the interest charged each month. The good news is that the interest you are charged will be listed each month on the loan account statements sent to you by the bank or credit union, and fully amortized loans will always cover the interest costs plus enough principal to pay off what you owe by the end of the loan term.

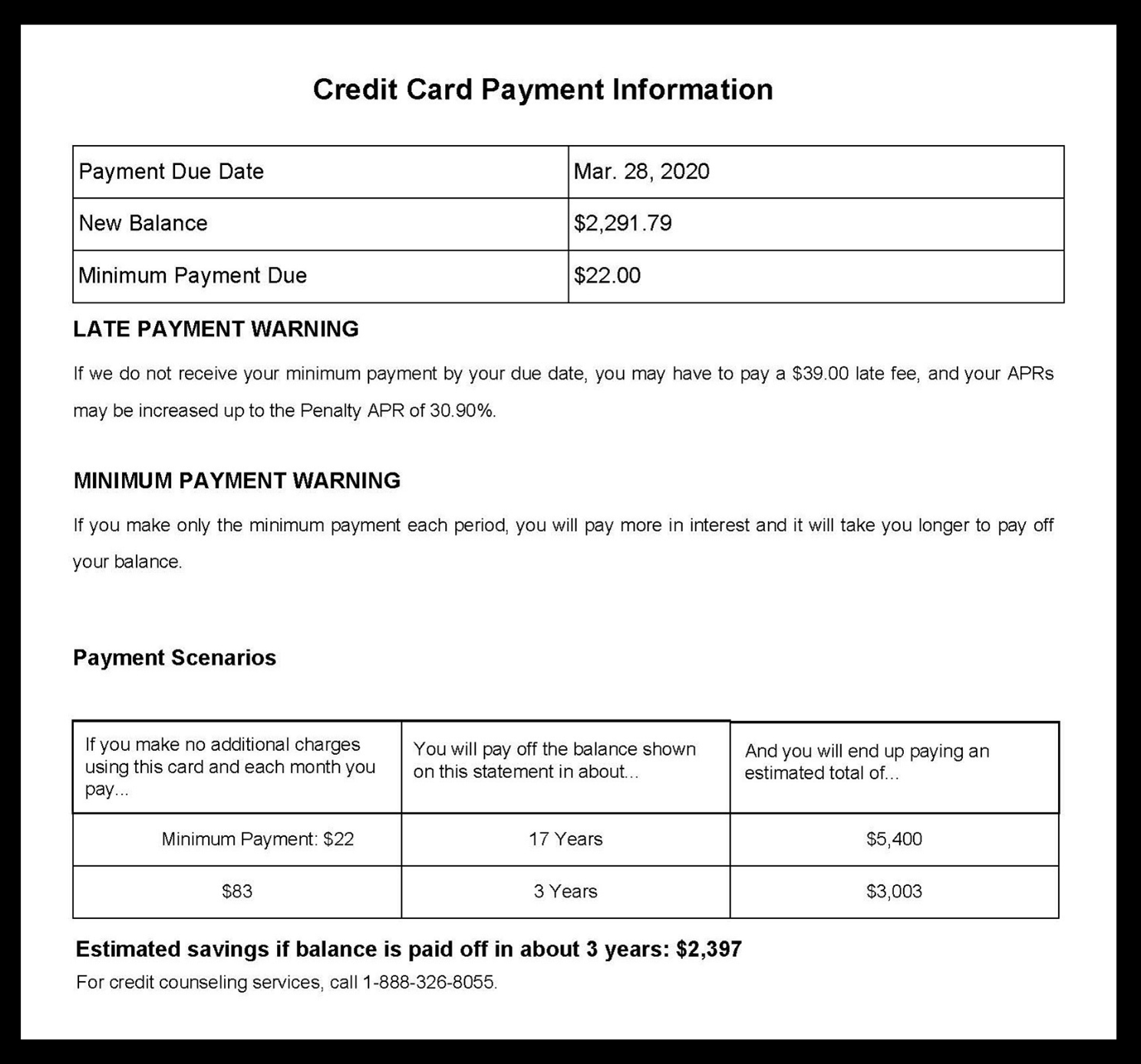

The two most common loans on which people get stuck paying compound interest are credit cards and student loans. Paying the minimum payment each month on a credit card will just barely cover the interest charged that month, while anything you buy with the credit card will begin to accrue interest on the day you make the purchase. Since credit cards charge interest daily, you’ll begin paying interest on the interest immediately, starting the compound-interest snowball to work against you. When you get a credit card, always pay the credit card balance down to zero each month to avoid the compound interest trap.

Student loans are another way you can be caught in the compound-interest trap. When you have an unsubsidized student loan or put your loans into deferment, the interest continues to rack up on the loans. Again, you’ll be charged interest on the interest, not just on the original loan amount, which forces you to pay compound interest on the loan.

Sacrificing Your Future Fun

When you graduate from college, you are most likely to graduate with student loan debt and credit card debt. Many students use credit cards and student loans to finance fun today, such as trips, clothing, and expensive meals.

Getting into debt while in college forces you to sacrifice your future fun. Say you take out $100,000 in student loans instead of the $50,000 you need, which doubles your monthly payment. You are not just making an extra $338 payment; you are also sacrificing anything else you can do with that money. You sacrifice that extra $338 a month, every month, for the next twenty-five years. You can’t use it to go to the movies, pay down other debt, save for a home, take a vacation, or throw a party. When you sign those papers, you sacrifice all those opportunities every month for decades. As a result, when you take out a loan, you should make sure it’s a good loan and only for the amount you truly need.

Getting and Using a Credit Card

One of the most controversial aspects of personal finance is the use of credit cards. While credit cards can be an incredibly useful tool, their high interest rates, combined with how easily credit cards can bury you in debt, make them extremely dangerous if not managed correctly.

Benefits of a Credit Card

There are three main benefits of getting a credit card. The first is that credit cards offer a secure and convenient way to make purchases, like using a debit card. When you carry cash, you have the potential to lose the money lost or have it stolen. A credit card or debit card, on the other hand, can be canceled and replaced at no cost to you.

Additionally, credit cards offer greater consumer protections than debit cards do. These consumer protections are written into law, and with credit cards you have a maximum liability of $50. With a debit card, you are responsible for transfers made up until the point at which you report the card stolen. In order to have the same protections as with credit cards, you need to report the card lost or stolen within 48 hours. The longer you wait to report the loss of the card, or the longer it takes you to realize you have lost your card, the more money you may be responsible for, up to an unlimited amount.

The final benefit is that a credit card will allow you to build your credit score, which is helpful in many aspects of life. While most people associate a credit score with getting better rates on loans, credit scores are also important for getting a job, lowering car insurance rates, and finding an apartment.

What Is a Good Credit Score?

Most credit scores have a 300–850 score range. The higher the score, the lower the risk to lenders. A “good” credit score is in the 670–850 score range.

| Credit Score Ranges | Rating | Description |

|---|---|---|

| < 580 | Poor | This credit score is well below the average score of US consumers and demonstrates to lenders that the borrower may be a risk. |

| 580-669 | Fair | This credit score is below the average score of US consumers, though many lenders will approve loans with this score. |

| 670-739 | Good | This credit score is near or slightly above the average score of US consumers, and most lenders consider this a good score. |

| 740-799 | Very Good | This credit score is above the average score of US consumers and demonstrates to lenders that the borrower is very dependable. |

| 800+ | Exceptional | This credit score is well above the average score of US consumers and clearly demonstrates to lenders that the borrower is an exceptionally low risk. |

How to Improve Your Credit

The main action you can take to improve your credit score is to stop charging and pay all bills on time. Even if you cannot pay the full amount of the credit card balance, which is the best practice, pay the minimum on time. Paying more is better for your debt load but does not improve your score. Carrying a balance on a credit card does not improve your score. Your score will go down if you pay bills late or owe more than 30 percent of your available credit. Your credit score is a reflection of your willingness and ability to do what you say you will do—pay your debts on time.

How to Use a Credit Card

All the benefits of credit cards are destroyed if you carry credit card debt. Credit cards should be used as a method of paying for things you can afford, meaning you should only use a credit card if the money is already sitting in your bank account and is budgeted for the item you are buying. If you use credit cards as a loan, you are losing the game.

Every month, you should pay your credit card bill off in full, meaning you will be bringing the loan amount down to zero. If your statement says you charged $432.56 that month, make sure you can pay off all of $432.56. If you do this, you won’t pay any interest on the credit card.

But what happens if you don’t pay it off in full? If you are even one cent short on the payment, meaning you pay $432.55 instead, you must pay daily interest on the entire amount from the date you made the purchase. Your credit card company, of course, will be perfectly happy for you to make smaller payments—that’s how they make money. It is not uncommon for people to pay twice as much as the amount purchased and take years to pay off a credit card when they only pay the minimum payment each month.

What to look for in your initial credit card:

- Find a low-interest-rate credit card.

- Avoid cards with annual fees or minimum usage requirements.

- Keep the credit limit equal to two weeks’ take-home pay.

- Avoid rewards cards that have an annual fee or high purchase requirements.

Quick Quiz 7.5

- What is interest? When is it positive or negative?

- Why is it best to start investing as early as possible?

- What are the pros and cons of having a credit card?

- How does your credit score affect you?

Licenses and Attribution

CC Licensed Content

- College Success by Amy Baldwin is licensed CC BY. Access for free.

References

- DoughRoller, LLC. (n.d.). Credit card minimum payment calculator: How minimum payments cost you. AllCards. https://www.allcards.com/credit-card-minimum-payment/

- Federal Reserve Bank of St. Louis. (2018, September). How compound interest works [Infographic]. Open Vault Blog. https://www.stlouisfed.org/open-vault/2018/september/how-compound-interest-works

- United States Senate Federal Credit Union. (n.d.). Senate cents: A financial wellness blog. https://www.ussfcu.org/media-center/senate-cents-a-financial-wellness-blog/