7.8 Education Debt: Paying for College

Questions to consider:

- What are ways to pay for your college education?

- What choices should you consider when taking on student debt?

- What types of financial aid are available?

- How do you apply for financial aid?

As you progress through your college experience, the cost of college can add up rapidly. Worse, your anxiety about the cost of college may rise even faster as you hear about the rising costs of college and horror stories regarding the “student loan crisis.” It is important to remember that you are in control of your choices and the cost of your college experience, and you do not have to become a sad statistic.

Education Choices

Education is vital to life. Education begins at the start of our lives, and as we grow, we learn language, sharing, and to look both ways before crossing the street. We also generally pursue a secular or public education that often ends at high school graduation. After that, we have many choices, including getting a job and stopping our education, working at a trade or business started by our parents and bypassing further schooling, earning a certificate from a community college or four-year college or university, earning a two-year or associate degree from one of those same schools, or completing a bachelor’s or advanced degree at a college or university. We can choose to attend a public or private school. We can live at home or on campus.

Average College Annual Tuition and Fees Cost

| Type of School | Annual Tuition and Fees without Housing |

|---|---|

| Public Community College (2 yr.) | $4,027 |

| For-profit Community College (2 yr.) | $18,241 |

| Public University, In State (4 yr.) | $9,834 |

| Private College (4 yr.) | $40,713 |

You may need to adjust your college plan as circumstances change for you and in the job market. You can modify plans based on available funding opportunities (see the next section) and your location. You may prefer a community college-only education, or you may complete two years at a community college and then transfer to a university to complete a bachelor’s degree. Living at home for the first two years or during all of your college education will save a lot of money if your circumstances allow.

Types of Financial Aid: How to Pay for College

The true cost of college may be more than you expected, but you can make an effort to reduce it. While the price tag for a school might say $40,000, the net cost of college may be significantly less. The net price for a college is the true cost a family will pay once grants, scholarships, and education tax benefits are factored in. The net cost for the average family at a public in-state school is only $3,980. For a private school, financial aid reduces the cost for the average family from $32,410 per year to just $14,890.

If you haven’t visited your college’s financial aid office recently, it’s probably worth speaking with them. You must seek out opportunities, complete paperwork, and learn and meet the criteria, but it can save you thousands of dollars.

Grants and Scholarships

Grants and scholarships are free money you can use to pay for college. Unlike loans, you never have to pay back a grant or a scholarship. Students should be aware that many scholarships require recipients to maintain Satisfactory Academic Progress (i.e., keeping overall GPA above a 2.0 and completing all courses). Alamo Colleges offers numerous scholarships to its students. Students at Alamo Colleges submit one general scholarship application each academic year, and they are automatically considered for all Alamo Colleges Foundation scholarships and matched with eligible award opportunities. The deadline to apply is normally May 15 of each year. For more information, see the Alamo Colleges Scholarship webpage.

Federal Grants

Federal Pell Grants are awarded to students based on financial need. The Pell Grant can provide you with more than $6,000 per year in free money toward tuition, fees, and living expenses. If you qualify for a Pell Grant based on your financial need, you will automatically receive the funds.

State Grants

Most states also have grant programs for their residents, often based on financial need. Eleven states have even implemented free college tuition programs for residents who plan to continue living in the state. Even some medical schools are beginning to offer tuition-free education. Check your school’s financial aid office and your state’s department of education for details.

Employer Tuition Reimbursement and Scholarships

Many employers also offer free financial assistance to help employees go to school. A common work benefit is a tuition reimbursement program, in which employers will pay students extra money to cover the cost of tuition once they’ve earned a passing grade in a college class. Some companies are going even further, offering to pay 100 percent of college costs for employees. Check to see whether your employer offers any kind of educational support.

Federal Work-Study Program

The Federal Work-Study Program provides part-time jobs through colleges and universities to students who are enrolled at the school. The program offers students the opportunity to work in their field, for their school, or for a nonprofit or civic organization to help pay for the cost of college. If your school participates in the program, it will be offered through your school’s financial aid office.

Student Loans

Federal student loans are offered through the U.S. Department of Education and are designed to provide easy and affordable access to loans for school. You don’t have to make payments on the loans while you are in school, and the interest on the loans is tax-deductible for most people. Direct Loans, also called Federal Stafford Loans, have a competitive fixed interest rate and don’t require a credit check or cosigner.

Direct Subsidized Loans

Direct Subsidized Loans are federal student loans on which the government pays the interest while you are in school.

Direct Unsubsidized Loans

Direct Unsubsidized Loans are federal loans on which you are charged interest while you are in school. If you don’t make interest payments while in school, the interest will be added to the loan amount each year and will result in a larger student loan balance when you graduate.

Direct PLUS Loans

Direct PLUS Loans are additional loans that a parent, grandparent, or graduate student can take out to help pay for additional costs of college. PLUS loans require a credit check and have higher interest rates, but the interest is still tax-deductible. The maximum PLUS loan you can receive is the remaining cost of attending the school.

Private Loans

Private loans are also available for students who need them from banks, credit unions, private investors, and even predatory lenders. However, with all the other resources for paying for college, a private loan is generally unnecessary and unwise. Private loans will require a credit check and potentially a cosigner; they have higher interest rates, and the interest is not tax-deductible. As a general rule, you should be wary of private student loans or avoid them altogether.

Loan Repayment

Payments on student loans will begin shortly after you graduate or are no longer attending college. Most loans are paid off within 10 years. While many websites, financial “gurus,” and talking heads in the media will encourage you to pay off your student loans as quickly as possible, you should give careful consideration to your repayment options and how they may impact your financial plans.

Financial Aid

Take this first step—you will need to do it. The federal government offers a standard form called the Free Application for Federal Student Aid (FAFSA), which determines if you qualify for federal financial aid and also opens the door to nearly all other financial aid. Most grants and scholarships require you to fill out the FAFSA, and they base their decisions on the information in the application.

The FAFSA only requests financial information for the specific year you file your application. This means you will need to file a FAFSA for each year you are in college. Since your financial needs will change over time, you may qualify for financial aid even if you did not qualify before.

You can apply for the FAFSA through your college’s financial aid office or at studentaid.gov if you don’t have access to a financial aid office. Once you file a FAFSA, any college can gain access to the information (with your approval), allowing you to shop around for financial aid offers from colleges. Students can begin their FAFSA application in October for the upcoming academic year.

Maintaining Financial Aid

To maintain your financial aid throughout your time in college, you need to make sure you meet the eligibility requirements for each year you are in school, not just for the year of your initial application. The basic requirements include being a U.S. citizen or eligible noncitizen, having a valid Social Security number, and registering for selective service, if required. Undocumented residents may also receive financial aid and should check with their school’s financial aid office.

You must also meet satisfactory academic progress (SAP), which includes meeting a minimum grade-point average, taking and completing a minimum number of classes, and making progress toward graduation or a certificate. Your school will have a policy for satisfactory academic progress, which you can get from the financial aid office.

What to Do with Extra Financial Aid Money

One expensive mistake that students make with financial aid money is spending it on non-education expenses. Students often use financial aid, including student loans, to purchase clothing, take vacations, or dine out at restaurants. Nearly three percent spend student loan money on alcohol and drugs. While this may seem like fun now, these non-education expenses are major contributors to student loan debt, which will make it harder for you to afford a home, take vacations, or save for your retirement after graduation.

When you have extra student loan money, consider saving it for future educational expenses. Just like you will need an emergency fund throughout your adult life, you will want an emergency fund for college when expensive books or study abroad programs present unexpected costs. If you make it through your college years with extra money in your savings, you can use the funds to help pay down debt.

Quick Quiz 7.6

- What are the different ways you can get assistance in funding your college education?

- Which types of funding require you to pay the money back?

- What requirements do you have to meet to continue receiving financial aid?

Summary

In this chapter, you have been introduced to the wide range of factors that impact your health. Health is much more than keeping your physical body in good shape. Good health also includes your mental and emotional well-being.

The contributors to physical health include eating clean, non-processed food; staying hydrated; moving your body daily; and getting sufficient sleep. You now understand why it is necessary to prioritize sleep and that quality sleep is also dependent on the way you eat and exercise. You have identified ways to improve what you eat and how you sleep. With these changes, you should be able to fall asleep with ease, stay asleep all night, and wake up feeling energized. Your mind will be clear and sharp, and you’ll get more done in less time, massively increasing your productivity and your success in college.

You now understand that a certain level of stress is to be expected. Chronic stress, however, is damaging to the body, so it’s important to have a variety of tools to manage stress. Practicing mindfulness, deep breathing, and gratitude can have a powerful impact on your emotional, mental, and physical health.

Finally, we explored the aspects of financial literacy. There are many benefits to good financial management. Primarily, it generally allows you to do more of what you want with your life. When you have poor financial habits, too much of your money goes into other people’s pockets. But when you have good financial management habits, you can afford to do more because you have worked hard, separated needs from wants, saved and invested, and avoided credit card and debt pitfalls.

Licenses and Attribution

CC Licensed Content

- College Success by Amy Baldwin is licensed CC BY. Access for free.

References

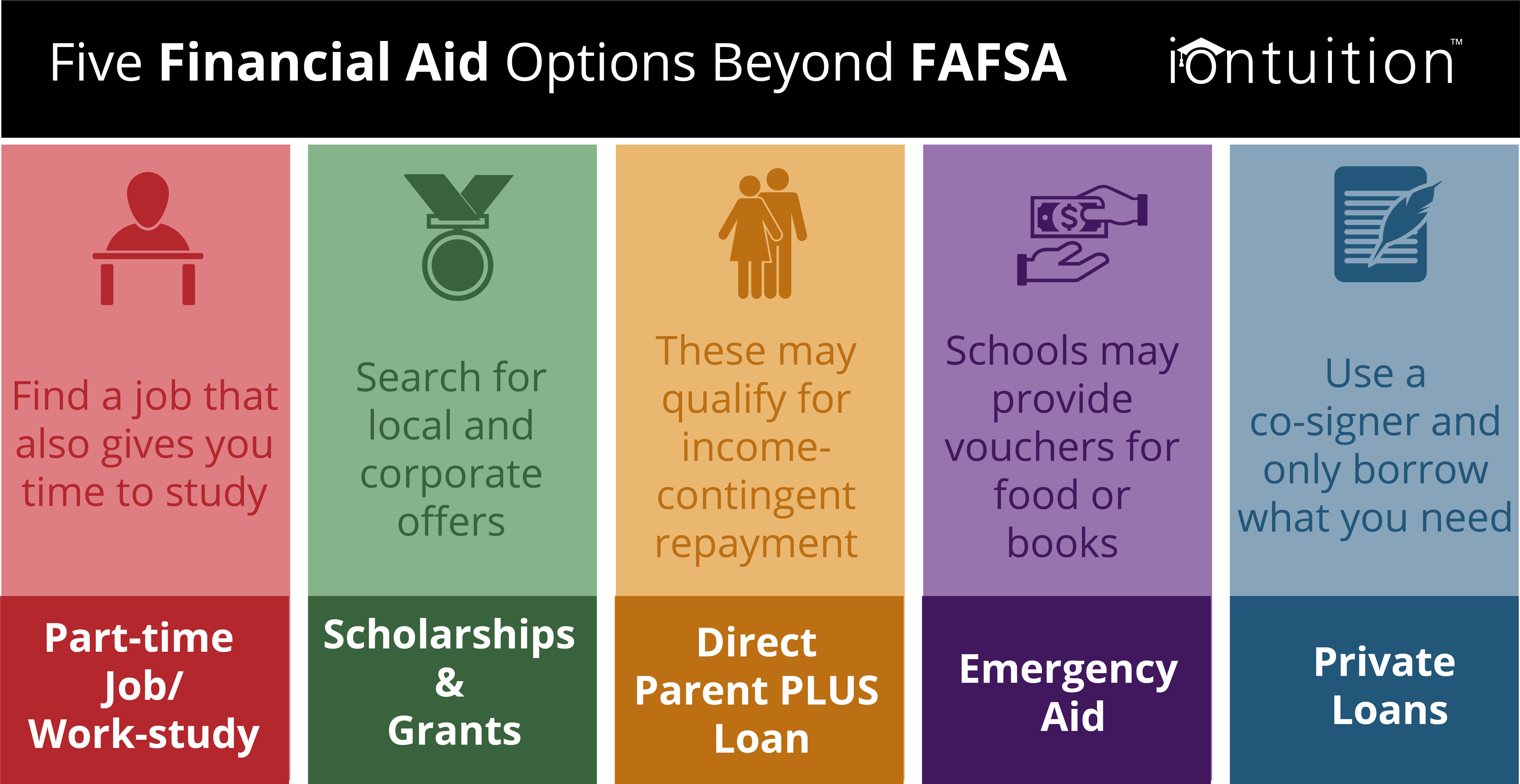

- Iontuition. (n.d.). Five financial aid options beyond FAFSA [Infographic]. https://www.iontuition.com/financial-aid-options-beyond-fafsa/

- National Center for Education Statistics. (2023). Undergraduate tuition, fees, room, and board charges for full-time students in degree-granting postsecondary institutions, by level and control of institution: 1963–64 through 2022–23 [Table]. U.S. Department of Education. https://nces.ed.gov/